Fintech Companies of the Carolinas:

Company:

![]()

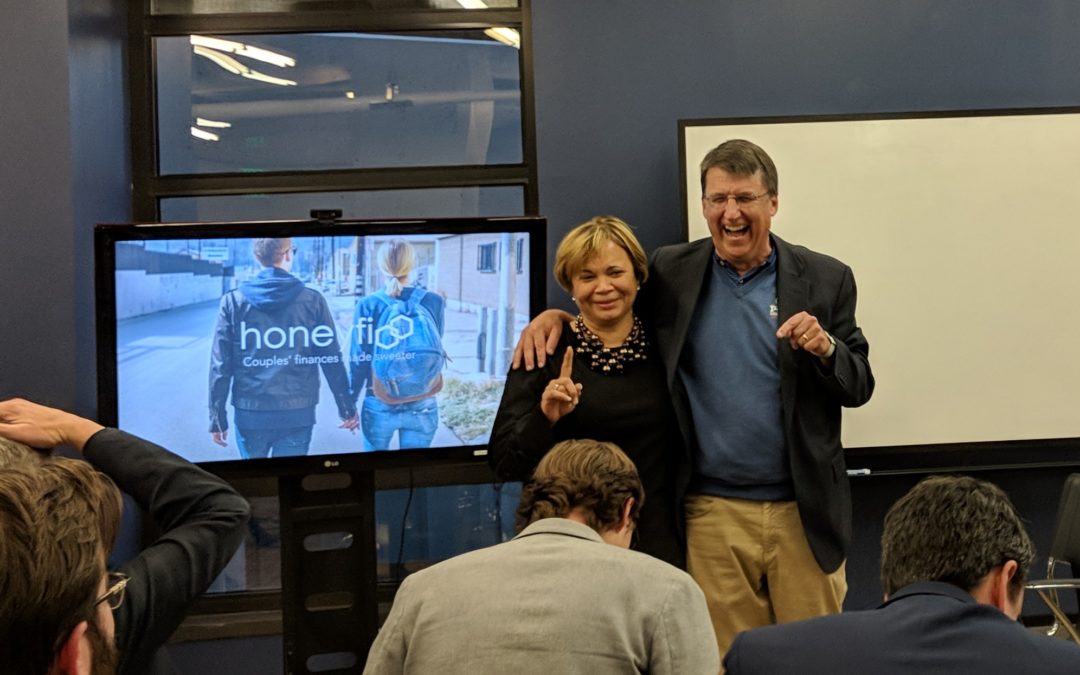

Leadership Team: Ramy Serageldin (CEO), Joe Stanish (COO), Sam Schultz (CAO)

Website/Social Platforms: www.honeyfi.com

Company Overview:

Honeyfi is an app to help couples manage their finances together (that’s right, we’re trying to save marriages). Our app is designed to help guide couples through the challenges that the various life stages present (moving in together, getting married, having a child, etc). Couples link their bank accounts and decide which accounts to share with each other. Within the app, the couple can see all of their transactions in one place, maintain a joint budget, communicate with each other about finances, and create, track, and achieve their savings goals as a team.

What is the inspiration for your company?

Each of the founders faced our own challenges managing money with our partners, which inspired us to start Honeyfi. In our CEO’s case, his inspiration came after one too many nights on the couch after “heated” discussions with his wife about their finances. They were living in NYC at the time, found out they were having their 3rd kid and it really sparked a conversation around where they wanted to live, how much could they afford, and they realized that they were wholly unprepared. When we started doing some research we found out we weren’t alone, in fact 58% of Millennial couples fight about money on a weekly or monthly basis. We set out to redefine joint finances and take the stress out of managing money with a partner.

Who is your competition and how do you distinguish your company?:

Our competition: Mint.com, YNAB, Qapital, Ostriching; Unlike the competition, Honeyfi was built from the ground up to serve the unique needs of couples, which means it is flexible enough to handle the unique ways couples think about household finances — whether you merge everything, keep everything separate, or something in between. Once you sign up, you link your accounts, choose which accounts you want to share with your partner and then you’re off. Honeyfi does all the heavy lifting to analyze your spending, create a budget for you (which you can edit), identify your recurring bills and highlight ways for you to save money each month. From there, it’s easy. Honeyfi helps you and your partner stay in sync by seeing all your household transactions and balances in one place, giving you tips to stay on track with your budget, and fun ways to collaborate with each other, like the ability to comment and react on tractions. But that is just the beginning, stay tuned for some exciting new features in the coming months!

Connection to Carolina Fintech Hub:

As a Charlotte-based company we try to be as actively involved in the community as possible. Our team members mentor companies in the QCF accelerator. We find that it is not only a great way to give back to other startups, but we also learn new things from the companies we’re mentoring. Our CEO is also a board member of the Finsiders organization. Finsiders is a professional organization that brings people together to discuss the intersection of banking, design, and technology in creative spaces. Finsiders also puts on in conjunction with QCF and the Carolina FinTech Hub an annual FinTech conference in the summer which attracts attendees from around the nation.

Recent Accomplishments and Challenges:

We launched out of Beta at the end of August 2017. Growth has been strong, in fact January was our best month yet! All growth has been from word of mouth, bloggers/influencers, or press coverage – US News & World Report, Entrepreneur, The Street and HuffPost (to mention a few!). We’ve also rolled out 2 key new features from customer feedback – Bills and Recommendations. To enable the bills feature, we use machine learning to identify the patterns of spend that make up recurring bills. Customers have responded really well to this feature, as it allows them to better forecast upcoming cash flows, and quickly identify if there was a significant variance form the expected amount. More recently, we launched the Recommendations section. We customize these recommendations throughout the app based on the transaction and profile data to make sure relevant offers are displayed to customers where it is most likely to get viewed.

As with any business there have been challenges. We’ve of course faced the product-market fit challenges that any company faces. We are breaking new ground with our focus on couples and learning as we go. However, one of the first challenges we faced, was where we would locate our company. 2 of our founders were living in New York City and 1 on San Francisco. We looked at different markets, and ultimately landed on Charlotte. We chose Charlotte because it offered the best mix of what we were looking for – a growing entrepreneurial ecosystem, strong banking focus, lower cost of living (we have kids!), and great access to talent. We’re excited about growing our company here.

What is Next?… (for you, the industry, the next 5 years?)

Honeyfi has lots of new product features coming in the next few months. We’d tell you, but they’re a secret. So, sign up to find out!

The industry is changing very rapidly. A couple trends we’re following: 1) We’re excited to see transition from FinTechs vs. Banks to FinTechs partnering with Banks. The combination of the innovative ideas from the FinTechs and scale from the Banks can lead to some pretty great results and ultimately, happier customers. 2) Blockchain, Blockchain, Blockchain – We think in the next 5 years, we’ll see some of the more interesting (non-cryptocurrency) use cases come into the main stream. Areas like trade finance, land ownership records and estate planning are ripe for disruption.